Kenmare Resources (LSE: KMR): Merger Arbitrage Opportunity with Underlying Value as Downside Protection

Value small cap with ~3x EV/EBITDA and 30-50% return potential in merger arbitrage. Reading time: 11 minutes

Teaser (Pretty Much All You Need To Know):

Merger Arbitrage Opportunity: A recent tender offer at 530 pence per share offers a 32% premium over the current share price (402p). The bidding consortium is led by the ex-Managing Director and founder of the business Michael Carvill

Attractive Valuation in a No-Deal Scenario: At ~3x EV/EBITDA, the business is still attractive even if the deal does not go ahead. Note the stock traded consistently above 400p/share for close to 3 years up until late 2023, with recent weakness in the share price mainly due to a large ongoing capex plan due to be largely complete by late 2025/2026

Highly Cash Generative Business: ~19% FCF yield supports growth capex plans and solid shareholder returns (~$280m cumulative since 2019 compared to $463m in current market cap)

Resilient Market with Growing Demand and Barriers to New Supply: Favorable long-term demand outlook driven by global GDP growth and urbanization in emerging markets

Long Asset Life: 100+ years of resource life remaining

Opportunity:

Kenmare Resources (LSE: KMR) is a leading global producer of titanium minerals, operating the Moma mine in Mozambique and headquartered in Dublin. Kenmare produces ilmenite (~72% of revenues), zircon (~18%), rutile (~3%) and other concentrates (~7%) which are essential raw materials in various industries from automotive to construction. For context, the main use of ilmenite is to produce titanium dioxide which is used in paints, plastics, textiles and a number of other areas.

Kenmare was founded in 1986 by Michael Carvill and has a long operational track record of producing high-quality ilmenite, with sustainable mining practices and low-cost production (1st quartile in the industry’s cost curve). The company is listed on the London Stock Exchange with a secondary listing on Euronext Dublin. Kenmare is a member of the FTSE All-Share Index.

Tender Offer:

The tender offer of 530p/share made last Thursday (March 6, 2025) by the founder and former Managing Director Michael Carvill (with >30 years at the helm of the business) together with Oryx Global Partners is ~90% above the pre-announcement share price, and still ~32% above the current share price of 402p as of March 10 (pre-market open). Michael has a deep understanding of Kenmare’s assets and operations and adds significant value from an operational perspective to the bidding consortium. Oryx Global is an Energy Transition focused investment group with a core focus on minerals and mineral mining businesses.

The Board of Directors rejected the offer, stating that it significantly undervalued the company and its future growth prospects given the recently weakened share price. However, the Board quickly offered to provide the consortium with information access to conduct due diligence and facilitate a potential improvement of the offer. Were the consortium to make a revised offer closer to 600p (~13% higher than the initial offer), it would be unlikely that the Board would reject it in my view as that would be ~115% higher than the share price pre-offer. With shares currently trading at 402p post bid announcement, investors coming into the equity now could still get ~30-50% returns within a few months if this scenario materializes. Note that under Irish Takeover Rules the bidding consortium has until the 17th of April to either announce a firm intention to make an offer or withdraw from the takeover process.

I know what you’re thinking… what if there’s no revised bid, or what if there is one and the Board still rejects it? We’ll get into more details on the company below, and while that is indeed a risk in the short term, Kenmare's fundamentals still make it an attractive long-term investment if the takeover does not materialize, and I’m happy to own it at 402p even if in the short term we might see volatility. Note also that up until very recently the shares traded consistently above 400p for ~3 years up until late 2023, with price weakness since then mainly due to the large ongoing capex plan (on which I’ll elaborate below), as well as a decrease in commodity prices and temporary production decreases (also covered below, not long term concerns in my view), and more recently the civil unrest in Mozambique (no impact on operations to date).

What If There Is No Acquisition? A Long-Term Hold Scenario:

Kenmare is highly cash generative, with $153m in cash from operations and $87m of free cash flow in 2023, resulting in a ~19% FCF yield at today’s market cap of $463m (£359m). It is key to also consider the ongoing capex plans and adjust for those to get a good estimate of future FCF. If we strip out growth capex (~$31m in 2023), FCF would be ~$118m post sustaining capex only. The ongoing growth capex plan will likely result in low/negative FCF in the short term, but I expect the company to return to $100m+ FCF post 2026 resulting in >20% FCF yields at the current valuation.

With a healthy balance sheet with only ~$25m net debt, the business is well positioned to finance its growth. $463m in market cap and $25m in net debt results in an EV of ~$488m. This implies a 2.2x multiple on the 2023 EBITDA and likely close to ~3x on the 2024E EBITDA to be released on the 26th of March. This is partly due to the high capex plan ahead, but nevertheless I view this valuation as very attractive for a business with over 100 years of resource life remaining at the current production rate. This is likely what the bidding consortium believes as well, hence the 530p/share bid.

Moreover, the company has a capital allocation policy that is very shareholder-friendly with $280m returned to shareholders since 2019, and while the dividend yield is difficult to predict given capex requirements, it may well remain above or close to 10% even during the ongoing growth projects as these are financed by operations and the RCF.

So… Why Has Share Price Been Underperforming? 3 key reasons:

1. WCP A Capital Expenditure (#1 Driver of Underperformance):

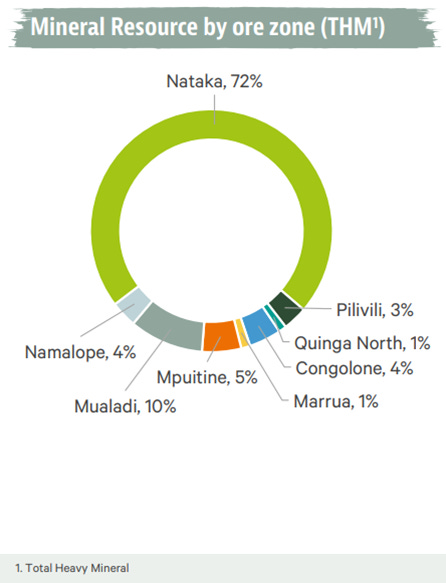

Kenmare is currently investing $341 million in the upgrade and transition of the Wet Concentrator Plant A (“WCP A”) to the Nataka mining area within the same mine. This is an 18-month transition path initiated in 2024 and is expected to be completed by the end of 2025, with a part of the capex to be spent in 2026 (contingency mainly). This project is vital for maintaining long-term production capacity and accessing high-grade ore, as moving WCP A to Nataka unlocks the majority of Kenmare’s 9.0bnt mineral resources, securing production at Moma for decades following the relocation.

It’s important to mention at this stage that Kenmare has 3 operational plants (A, B and C):

WCP A: 3,250 tons per hour (“tph”) → Undergoing a transition to Nataka, expected to be completed in late 2025 – see more details below

WCP B: 2,400tph → No major capex plan ongoing. Management has highlighted the potential to eventually upgrade WCP B to 3,400tph (+42% capacity) – consider this an upside case if you will

WCP C: 500tph → No major capex plan ongoing. WCP C will remain in Namalope region until ~2030, and will then move to Nataka (at a low relocation costs low due to its small size )

Per the Q4’24 trading update provided in Jan’25, the WCP A transition is advancing well and remains on track for completion in late 2025 and within budget, although significant capital expenditure has shifted from 2024 to 2025. New dredges are nearing completion in the Netherlands and will be transported by sea to be commissioned in Q3’25. Other key components are on-site and also set for Q3 commissioning. The new tailings storage facility has been delayed to Q4’25 due to permitting delays around the Mozambican elections in Q4’24. Some capex has been scheduled for 2026 which I understand to be mainly contingency and post transition works which should not impact production.

Expenditure on development projects and studies is expected to be approximately $155 million in 2025, with $150 million relating to the WCP A project. Kenmare had guided in July 2024 that capital expenditure on the WCP A project would be $128 million in 2025 but a portion of the 2024 capex was deferred to 2025 – no budget overruns for the time being.

WCP A Capex Schedule (updated per Jan’25 trading update):

Management is confident that capex can be fully funded with existing resources including an existing RCF facility, with no equity injections needed, which I believe to be a safe assumption as well - see the bridge chart below. However, while management also seems confident in the company’s ability to continue paying dividends, I would be cautious to assume that at this stage if this was absolutely needed to give me comfort in my investment thesis – not to say we should expect a dividend cut, but there is a world in which they have to cut it temporarily to fund the peak of capex in 2025 in my view and investors should be prepared for that. All in all, this is not a risk for the long-term focused investor as I see no reason why they would not return to a strong shareholder return policy in 2026+.

2. Production Decrease and Lower Commodity Prices:

I’ll try to keep this paragraph short. In H1’24, there were production issues, with shipments down 14% YoY due to poor weather conditions and issues with the conveyor belt. Both issues were temporary in nature and the appropriate maintenance work on the conveyor belt has been completed. The Q4’24 trading update released in January showed +4% YoY increase in shipment for FY24 vs FY23, with Q4’ results showing QoQ increases of +14% in ilmenite output, +6% in zircon output and +16% in rutile output.

Regarding commodity prices, we are seeing a correction from the bull market leading up to 2022-23 (see the chart below). However, the long-term outlook for titanium dioxide demand remains very positive, with secular tailwinds driven by global GDP growth, increased urbanization in emerging markets and key industries such as automotive (requiring titanium dioxide for painting) providing further tailwinds given the push for electric vehicles. Global demand growth is forecasted to grow at 4-8% CAGR by 2034, according to different estimates available in the public domain.

Most importantly, the growing imbalance in supply and demand as evidenced by the chart below is a key tailwind of prices over the long term. Medium-term supply constraints of 1.5Mt TiO2 units (~3Mt ilmenite) of new supply required to meet demand by 2027, with recent feedstock prices not expected to incentivize sufficient new supply. Moreover, there are significant barriers to increasing supply, driven by environmental challenges, regulatory bodies as well as sovereign risk associated with typical mining site locations.

3. Mozambique Civil Unrest:

More recently, civil unrest in Mozambique has also been a concern for investors following the October 2024 elections, particularly in the capital Maputo. Kenmare’s Moma mine is ~1,300km north of Maputo in the northern coastal region, and while smaller protests have taken place closer to the site, Kenmare’s operations have been generally insulated from the impacts of the conflict. Production has continued without any interruptions and no damage to infrastructure has been reported.

The broader security situation creates a degree of political and operational risk. I am no expert on Mozambique politics and suggest that others make their research on the subject independently as well. While there’s been no direct impact on production, the potential for escalation and spillover effects remains a relevant factor to consider. I take some comfort knowing that no employees have been relocated, and that Kenmare’s management is often present on-site. The company has also implemented security protocols and contingency plans to mitigate potential disruptions and continues to prioritize the stability of its operations and the safety of its employees.

Key Risks to Consider:

The transaction may not materialize (the bidding consortium may step away)

WCP A project delays or cost overruns – I see some likelihood of a delay post Q4’25 into 2026 but little risk from a value standpoint

Political risks in Mozambique leading to operational disruptions

Commodity price volatility

Conclusion:

In my view, the offer made is an opportunistic bid for Kenmare given the impact that the large capex plan is having on the share price, further exacerbated by lower commodity prices and the civil unrest in Mozambique more recently. I see this as a compelling opportunity to invest in a merger arbitrage situation, backstopped by strong underlying value if the deal does not go ahead. A final offer of 530-600 pence per share would provide ~30-50% return in a very short timeframe, while a long-term hold scenario also appears attractive if the deal does not go ahead. The company's high-quality assets and strong financial profile support a valuation well above the current share price in my view (which is why the ex-Managing Director wants to buy it at an even higher price, and why the Board declined at 530p). At 402 pence a share, I am happy to own part of this business if the deal does not go ahead.

Disclaimer: The content on this website is for informational and educational purposes only and is not created to meet your personal financial situation. Nothing should be considered as investment advice or as a guarantee of profit. You are advised to consult with your financial advisors to discuss your investment options and whether it would be a suitable investment for your personal needs. The information used in this publication is from sources that are believed to be reliable, but the accuracy cannot be guaranteed. The opinions expressed are those of the author and the author only. These opinions are subject to change without prior notice.

Disclosure: The author currently owns shares in the shares of the company here discussed (LSE: KMR) as of March 10, 2025. The security could be sold at any point in time without prior notice.